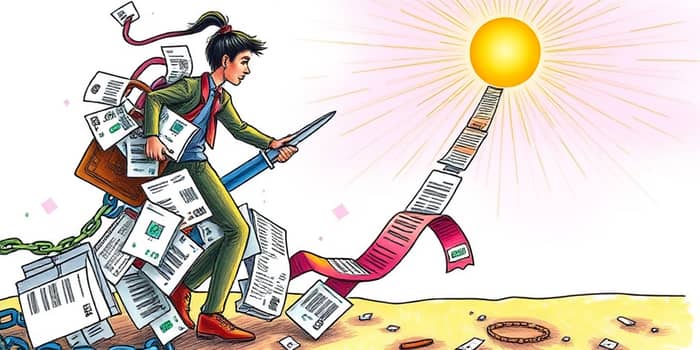

Carrying multiple debts can feel like juggling flaming torches—one missed payment risks everything crashing down. If you find yourself drowning in statements, interest charges, and due dates, a debt consolidation loan might be the lifeline you need. By combining multiple debts into a single loan, you can transform financial chaos into a clear, manageable plan.

In this comprehensive guide, we’ll explore how debt consolidation works, highlight potential benefits and pitfalls, and walk you through each step toward a more secure financial future.

At its core, debt consolidation is the process of rolling various forms of debt—credit cards, medical bills, personal loans—into one new loan. Instead of juggling several payments on different dates, you make one monthly payment with a fixed schedule. This streamlined approach can reduce confusion, lower your interest rates, and provide a clear end date for becoming debt-free.

While consolidation often involves a personal loan from banks, credit unions, or online lenders, alternatives include home equity loans, credit card balance transfers, or debt management plans. Choosing the right option depends on factors like your credit score, loan amount, and financial goals.

Though the idea seems simple, achieving a successful consolidation loan requires careful planning:

By following these steps, you create a structured path toward eliminating high-interest obligations and focusing on a single, predictable repayment.

Turning multiple obligations into one can yield significant advantages:

Consider this real-world example: If you owe $9,000 at a 25% APR with $500 monthly payments, you’d pay about $820 in interest over two years. By consolidating to a 17% APR, your payment drops to $445, saving you $820 in interest over two years. Keep paying $500 instead, and you clear debt even faster.

Despite its appeal, debt consolidation isn’t a universal solution. Be mindful of these challenges:

Moreover, surveys show that 18% of individuals who consolidate their debt expect to fall back into debt within six months. Discipline and budgeting are essential to making consolidation work.

A personal consolidation loan is not the only route. Evaluate alternatives to find the best fit:

Balance transfer credit cards can offer 0% APR promotions for a limited time, ideal for short-term payoff if you can clear balances before the promotional period ends. Meanwhile, home equity loans may provide lower rates but involve putting your property at risk.

Debt management plans arranged through certified credit counselors can negotiate lower interest and fees, but they often require closing existing credit accounts.

Securing a debt consolidation loan is only half the battle. To maximize benefits, implement these best practices:

First, draft a realistic budget that allocates every dollar toward essentials and debt repayment. Track spending habits and identify areas where you can trim excess.

Second, automate your payments. Automatic transfers remove the risk of missed due dates and reinforce consistent on-time payments, further boosting your credit history.

Finally, resist the urge to reopen settled credit accounts. If you clear a credit card with your loan, consider freezing the card or storing it away to prevent impulsive purchases.

Debt consolidation loans offer a transformative opportunity to regain stability and confidence. By consolidating high-interest debts into one structured plan, you can unlock greater financial clarity and achievable goals. Remember, the key to success lies in careful planning, disciplined budgeting, and avoiding new credit traps.

Whether you choose a personal loan, a balance transfer card, or a home equity plan, the principles remain the same: understand your options, compare costs, and commit to a repayment strategy. With the right approach, you’ll replace uncertainty with a clear path to a debt-free life.

Embrace the chance to simplify your finances and step into a future defined by freedom and peace of mind.

References